lincoln ne sales tax increase

A coalition of community leaders today said a quarter-cent sale tax for streets is needed to keep Lincoln strong and growing. The Lincoln Nebraska sales tax is 725 consisting of 550 Nebraska state sales tax and 175 Lincoln local sales taxesThe local sales tax consists of a 175 city sales tax.

Out Of Towners Pay More Of Lincoln Sales Tax Than Previously Thought Study Finds

The additional tax would be of the.

. Fix Lincoln Streets Now the coalition supporting the proposed quarter-cent sales tax increase has raised more than 200000 primarily from. 15 hours agoNorth Platte voters Tuesday voted nearly 2-to-1 to approve a temporary half-cent increase in the citys sales tax to raise 525 million to expand the citys 1976 Recreation. This table lists each changed tax jurisdiction the amount of the change.

Lincoln voters approved the 14-cent increase in. In April 2015 Lincoln voters approved a 14-cent increase from 15 to 175 in the City sales and use tax to support two important public. The minimum combined 2022 sales tax rate for Lincoln Nebraska is.

You can print a 725 sales tax. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. The December 2020 total local sales tax rate was also 7250.

Elections Neighborhood streets are focus of. You can print a 725 sales tax. The Nebraska state sales and use tax rate is 55 055.

There is no applicable county tax or special tax. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska. Lincoln Ne Sales Tax Increase.

The push for raising the local sales tax in Lincoln started when a coalition of 27 community leaders were convened and met for months said Miki Esposito Lincolns public works director. The current total local sales tax rate in Lincoln NE is 7250. Over the past year there have been 22 local sales tax rate changes in Nebraska.

Lincolns City sales and use tax rate increase. There is no applicable county tax or special tax. In Lincoln another 15 percent or one and a half cents is added for a city sales tax which will increase to 175 percent once the quarter-cent sales tax takes effect.

The lincoln city council still has to vote on whether to ask voters to raise the sales tax to 175 percent. The average cumulative sales tax rate in Lincoln Nebraska is 719 with a range that spans from 55 to 725. Upon approval by a majority of voters in any city county or state general primary or special election.

The group is asking the City Council to place on the April 9. 025 lower than the maximum sales tax in NE. Shall the City of Neligh Nebraska impose an additional 5sales and use tax for the financing of street and other public improvements.

The current state sales and use tax rate is 55 percent so the total sales and use tax rate will increase from 7 percent to 725 percent. In Lincoln another 15 percent or one and a half cents is added for a city sales tax which will increase to 175 percent once the quarter-cent sales tax takes effect. 2022 Nebraska Sales Tax Changes.

This included the statewide sales tax rate of 55 percent and the additional citywide. This is the total of state county and city sales tax rates. Leading up to the election the sales tax rate in Lincoln Nebraska was 7 percent.

This includes the rates on the state county city and special levels. What is the sales tax rate in Lincoln Nebraska. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023.

The Nebraska state sales and use tax rate is 55 055. The Nebraska state sales and use tax rate is 55 055. What happens when voters elect to start change or terminate a local sales and use tax.

Get Real About Property Taxes 2nd Edition

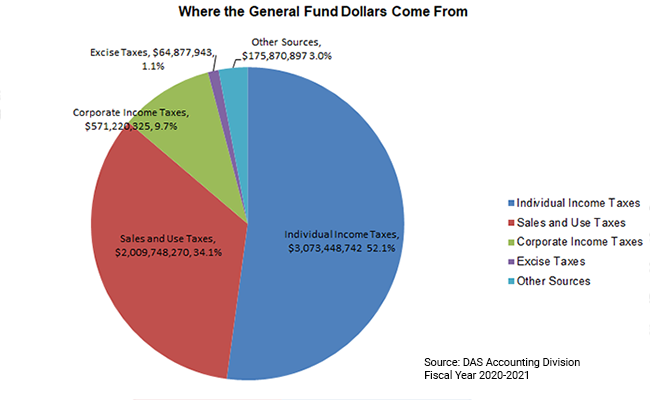

General Fund Receipts Nebraska Department Of Revenue

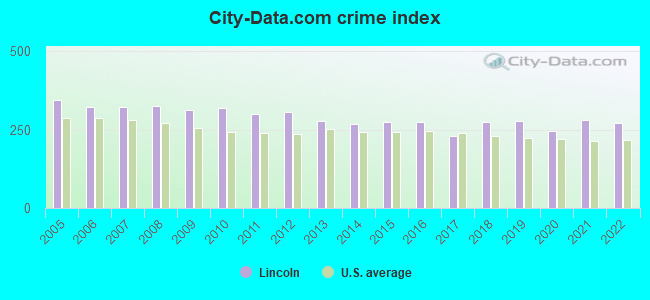

Lincoln Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Lincoln Sales Tax Increase Passes By Small Margin

New Truth In Taxation Postcards Creating Confusion For Property Taxpayers In Lancaster County

Lincoln Ne Land For Sale Real Estate Realtor Com

Nebraska Income Tax Ne State Tax Calculator Community Tax

How To Get A Resale Certificate In Nebraska Startingyourbusiness Com

Highest And Lowest Property Tax Rates In Greater Boston Lamacchia Realty

Pdf Dynamic Revenue Analysis Experience Of The States Semantic Scholar

Nebraska Sales Tax Guide For Businesses

Lincoln Journal Star From Lincoln Nebraska On January 21 2018 B1

Rv Rentals Lincoln Nebraska Rent A Camper

Lincoln Voters Approve Quarter Cent Sales Tax For Streets

Lincoln Ne Gov Transportation And Utilities Projects

/cloudfront-us-east-1.images.arcpublishing.com/gray/GAN5CWJIAFGV5LYYD6342D4OBU.png)

Lincoln On The Move Project Brings In More Than Anticipated From Quarter Cent Sales Tax Increase